Top 5 Trading Journal Software 2025 - Unbiased & Real Insights

If you've been trading for any length of time, you've probably heard the phrase "trading without a journal is like driving blindfolded." And honestly? It's true. Every successful trader I know keeps meticulous records of their trades, analyzing patterns, identifying mistakes, and building on wins.

But here's the thing – keeping a trading journal in 2025 isn't about dusty spreadsheets anymore. Today's best trading journal software offers everything from AI-powered insights to real-time market replay. Transforming how we track and improve our trading performance.

Whether you're hunting for a free trading journal to start your journey or ready to invest in premium features, this guide will help you find the perfect fit. Let's dive into the top platforms dominating the trading journal space in 2025.

Disclaimer: This post is not sponsored by any trading journal. However, it may contain affiliate links, which help support our site at no extra cost to you. All opinions expressed are independent and based on real user reviews and data gathered from trusted sources and official websites.

Why Every Trader Needs a Trading Journal (Even If You Think You Don't)

Before we jump into the software reviews, let's address the elephant in the room. Maybe you're thinking, "I can remember my trades" or "I'll just use Excel." Trust me, I've been there. When I started trading, I thought I could keep everything in my head. Spoiler alert: I couldn't.

A proper trading journal helps you:

- Identify patterns in your winning and losing trades

- Track your emotions and how they affect your decisions

- Measure your actual performance (not just what you think you're doing)

- Improve your strategy based on real data, not feelings

- Build confidence by seeing your progress over time

The best part? Modern trading journal software does most of the heavy lifting for you. No more manual data entry or trying to remember what you were thinking during that 2 PM trade.

Quick Comparison: Top Trading Journal Software 2025

Before we dive deep into each platform, here's a quick overview of what we're working with:

| Software | Starting Price | Free Plan | Mobile App | AI Features | Best For |

|---|---|---|---|---|---|

| TraderSync | $29.95/month | 7-day trial | iOS & Android | ✅ Premium+ | Heavy volume traders |

| TradesViz | Free | ✅ Up to 3,000 trades | Web App | ✅ AI Q&A | Budget-conscious traders |

| TradeZella | $24/month | ❌ | Web App | ❌ | New traders wanting guidance |

| Edgewonk | $169/year | 14-day refund | Web App | ✅ Rule alerts | Psychology-focused traders |

| Tradervue | $29.95/month | ✅ 30 trades/month | Web only | ❌ | Community-focused traders |

1. TraderSync: The Premium Powerhouse

When it comes to comprehensive trading journal software, TraderSync sits at the top of the mountain. It's like the Swiss Army knife of trading journals – packed with features but with a price tag to match.

What Makes TraderSync Special

TraderSync's biggest selling point is its massive broker integration. We're talking 900+ brokers with automatic import capabilities. Whether you're trading stocks, options, futures, forex, or crypto, TraderSync can pull your data directly from your broker. No more manual CSV uploads (unless you want to).

But here's where it gets interesting – TraderSync's AI assistant. Starting with the Premium+ plan, you can ask questions like "Show me all my losing trades on Friday afternoons" or "What's my win rate when I hold positions overnight?" The AI doesn't just spit out numbers; it helps you understand patterns in your trading behavior.

TraderSync Features That Matter

- Automatic trade import from 900+ brokers

- AI-powered pattern recognition (Premium+ and Elite)

- Strategy checker to validate your trading rules

- Market replay functionality (Elite only)

- Native mobile apps for iOS and Android

- Comprehensive reporting including MAE/MFE analysis

"TraderSync changed how I approach my trading. The AI insights showed me patterns I never would have noticed manually." - Verified user review

TraderSync Pricing

| Plan | Monthly | Annual | Key Features |

|---|---|---|---|

| Pro | $29.95 | $312.60 | Core journaling, full reports |

| Premium | $49.95 | $521.40 | AI assistant, strategy checker |

| Elite | $79.95 | $834.60 | Trading plans, market replay |

All plans include a 7-day free trial

Who Should Use TraderSync

TraderSync is perfect for serious traders who make a lot of trades and want comprehensive analytics. If you're trading multiple markets or need detailed strategy validation, the price might be worth it. However, if you're just starting out or trading occasionally, you might want to consider other options first.

Check out the latest TraderSync deals and discounts to see if you can save on your subscription.

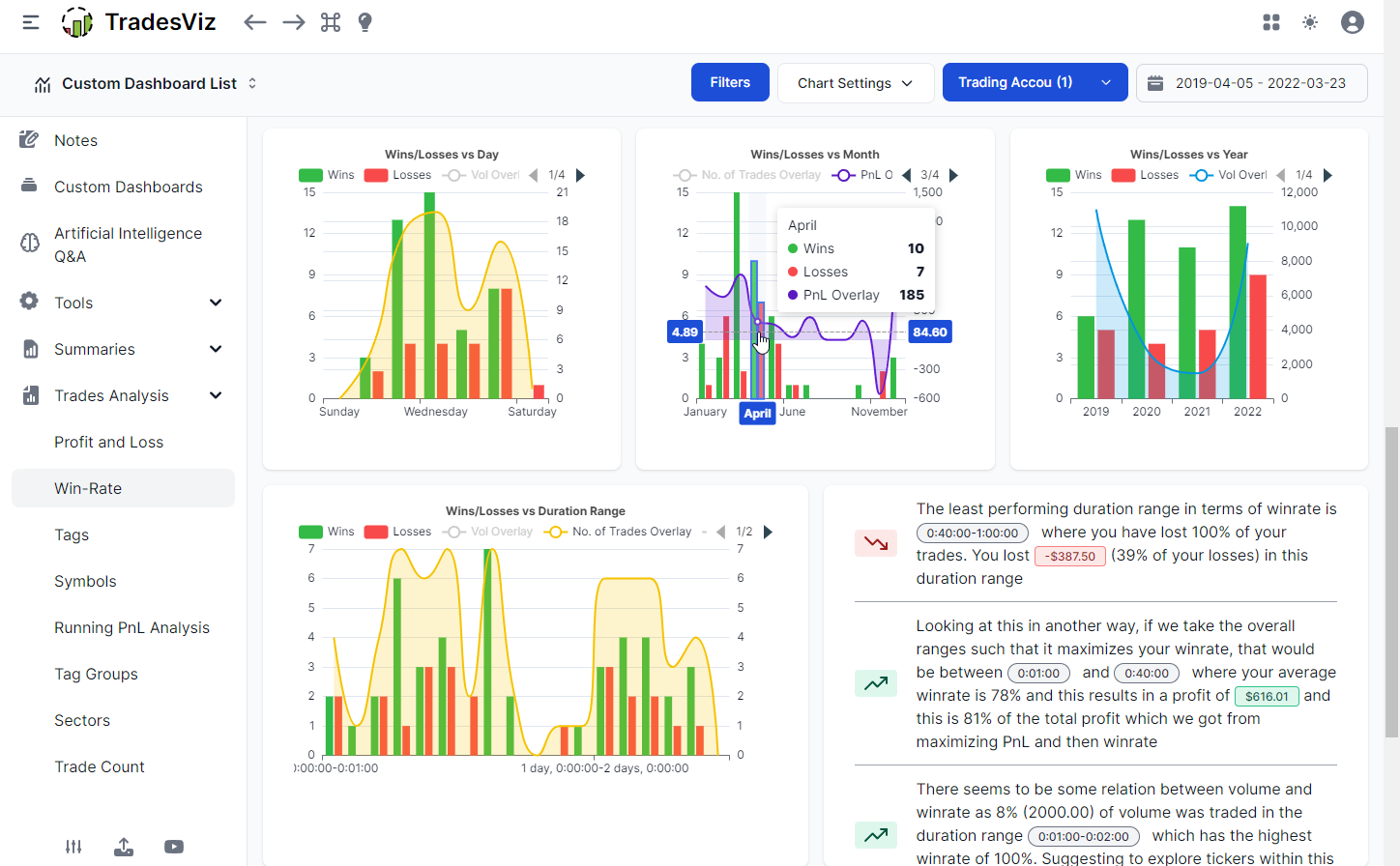

2. TradesViz: The Value Champion

Here's where things get interesting. TradesViz positions itself as the "feature-rich alternative at one-third the price," and honestly, they're not wrong. This platform offers a surprisingly robust free tier that might be all you need.

What Makes TradesViz Stand Out

TradesViz's secret sauce is its combination of affordability and depth. The free Basic plan lets you store unlimited trades (up to 3,000 executions per month) and gives you access to basic analytics. For most new traders, this is more than enough to get started.

But here's where TradesViz gets really interesting – their simulator and backtesting features. You can replay actual market conditions at 1-100x speed, test different strategies, and even practice with multiple asset classes. It's like having a time machine for your trading education.

TradesViz Features That Matter

- Free tier with unlimited trade storage (up to 3,000 executions)

- 600+ pre-built statistics and custom dashboards

- Multi-asset trading simulator with historical data

- AI Q&A for custom analytics

- Automated goal tracking and milestone gamification

- Options flow analysis and backtesting for 30,000+ symbols

TradesViz Pricing

| Plan | Annual Cost | Monthly Equivalent | What You Get |

|---|---|---|---|

| Basic | Free | Free | 3,000 executions, basic analytics |

| Pro | $179 | $14.99 | Unlimited trades, advanced features |

| Platinum | $269 | $22.49 | Premium simulators, advanced AI |

7-day free trial available for paid plans

Who Should Use TradesViz

TradesViz is perfect for traders who want powerful analytics without breaking the bank. The free tier is genuinely useful for beginners, while paid plans offer professional-grade features at a fraction of TraderSync's cost. If you're into backtesting or want to practice with market simulators, TradesViz is hard to beat.

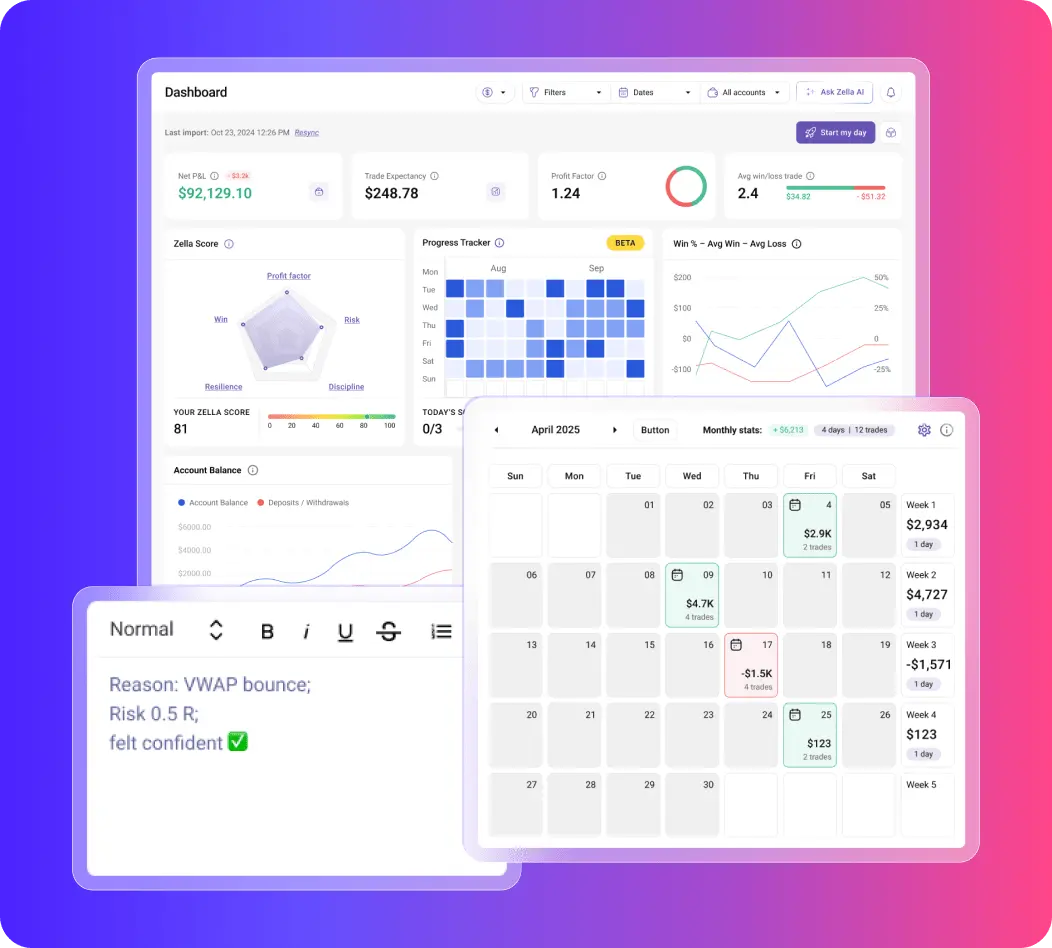

3. TradeZella: The User-Friendly Choice

Founded by trader-educator Umar Ashraf, TradeZella takes a different approach to trading journals. Instead of overwhelming you with features, it focuses on ease of use and education. Think of it as your friendly trading mentor in software form.

What Makes TradeZella Special

TradeZella's biggest strength is its approach to trader education. The platform includes "Playbooks" – basically step-by-step guides for improving your trading. You get 3 playbooks on the Basic plan and unlimited on Pro. There's also a "Mentor Mode" where experienced traders can review your journal and provide feedback.

The interface is clean and modern, making it easy to navigate even if you're not tech-savvy. Everything is designed to help you learn and improve, not just track your trades.

TradeZella Features That Matter

- Clean, modern interface that's easy to use

- Auto-import from 20+ brokers with manual CSV upload

- Trade Playbooks for structured learning

- Mentor Mode for getting feedback from experienced traders

- Options flow scanner and earnings insights

- Trade replay with second-by-second analysis (Premium)

TradeZella Pricing

| Plan | Monthly | Annual | Mobile Access |

|---|---|---|---|

| Basic | $29 | $24/month ($288) | Web app only |

| Pro | $49 | $33.25/month ($399) | Web app only |

Currently, TradeZella only offers web-based access, but it works well on mobile browsers

Who Should Use TradeZella

TradeZella is ideal for newer traders who want guidance alongside their journaling. The educational components and mentor system make it more than just a tracking tool – it's a learning platform. However, if you need native mobile apps or the most advanced analytics, you might want to look elsewhere.

For comparison between popular options, check out this detailed TraderSync vs TradeZella comparison.

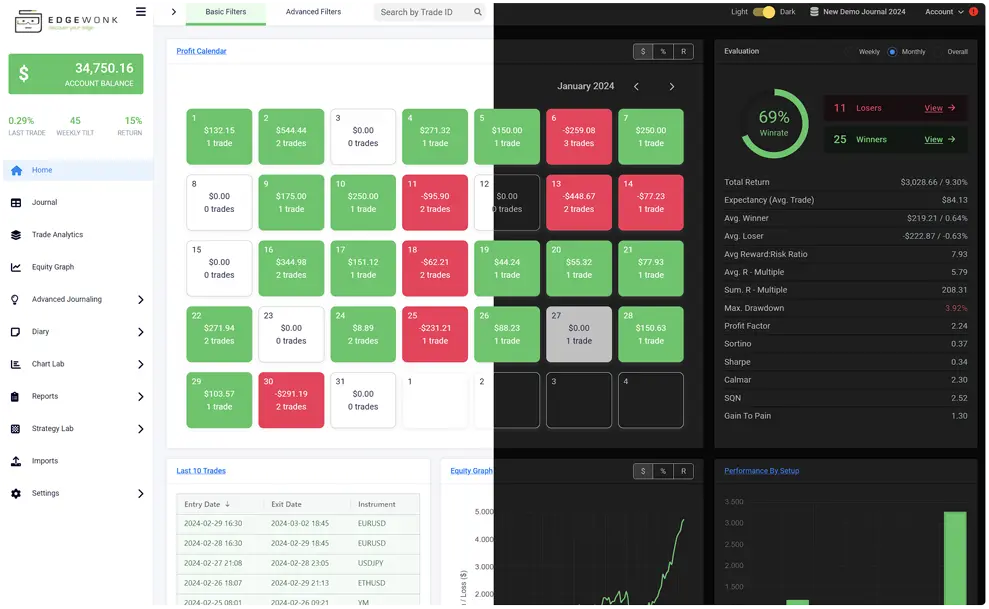

4. Edgewonk: The Psychology-Focused Platform

If you've ever blown up an account due to emotional trading (haven't we all?), Edgewonk might be your new best friend. This platform focuses heavily on the psychological aspects of trading, helping you understand not just what you trade, but why you trade.

What Makes Edgewonk Unique

Edgewonk's secret weapon is its focus on trader psychology. The platform includes 20 custom tag categories, space for 6 screenshots per trade, and comprehensive diary tools. But here's the kicker – it gives you real-time notifications when you're about to break your trading rules.

The "Edgewonk Score" is a proprietary KPI that measures your overall trading performance, considering both profits and adherence to your rules. It's like having a report card for your trading behavior.

Edgewonk Features That Matter

- 20 custom tag categories for detailed trade categorization

- Comprehensive diary tools for recording thoughts and emotions

- Real-time rule breach notifications

- Edgewonk Score performance metric

- Milestone gamification to keep you motivated

- Mentor share mode for coaching sessions

Edgewonk Pricing

Edgewonk keeps it simple with one all-inclusive plan at $169 per year (roughly $14 per month). They offer a 14-day money-back guarantee, and there's no monthly billing option – it's annual only.

Who Should Use Edgewonk

Edgewonk is perfect for traders who struggle with emotional control or want to improve their trading psychology. If you find yourself making the same mistakes repeatedly or want to build better trading habits, the psychology-focused approach might be exactly what you need.

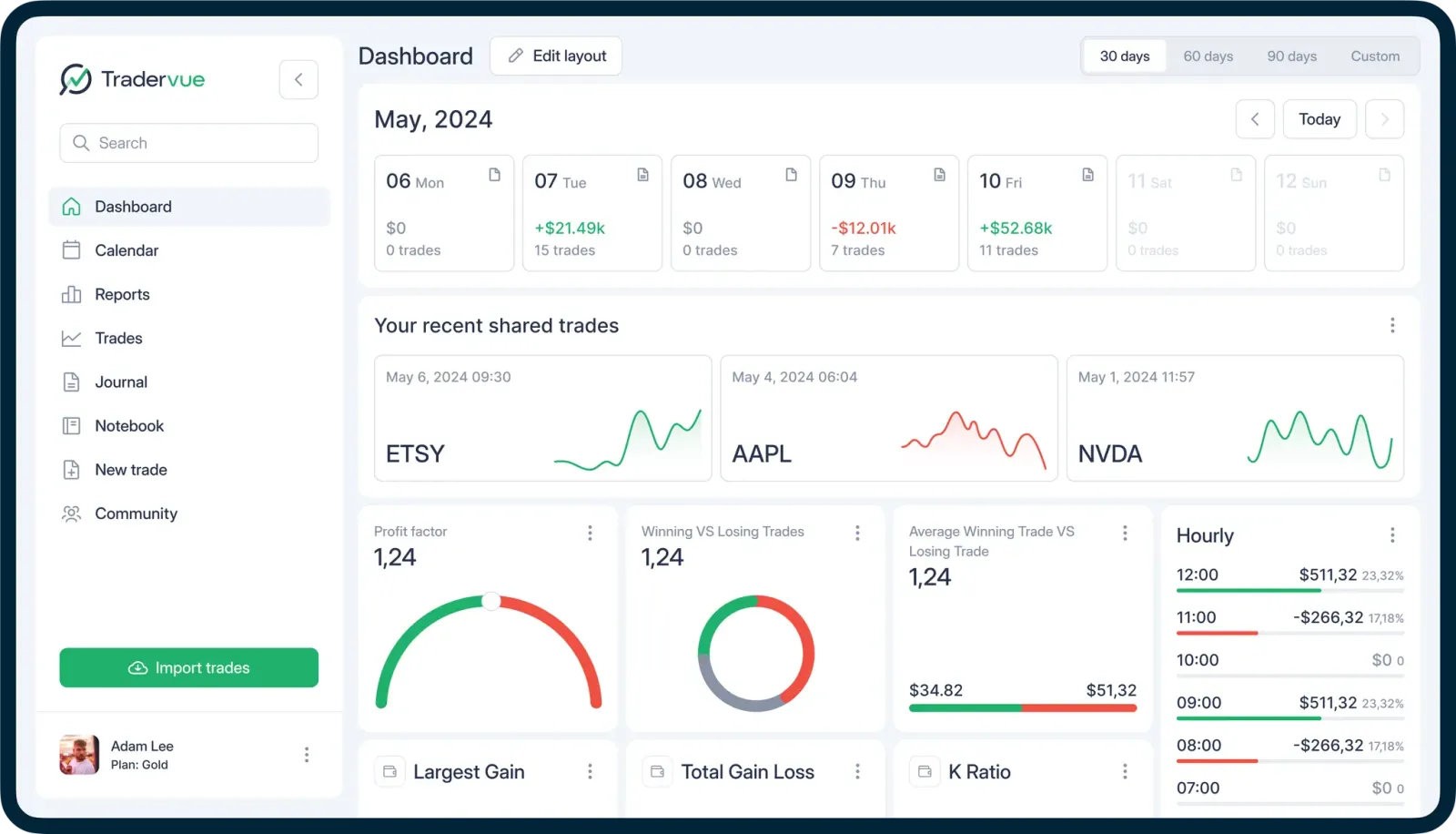

5. Tradervue: The Community-Focused Veteran

Tradervue is the old-timer in the trading journal space, but don't let that fool you. This platform has been around long enough to understand what traders actually need, and it's built a loyal community along the way.

What Makes Tradervue Special

Tradervue's unique selling point is its social aspect. You can share trades publicly, get feedback from other traders, and follow successful traders to learn from their strategies. It's like social media for traders, but focused on education and improvement.

The platform also offers a limited but useful free tier with 30 trades per month – perfect for occasional traders or those just starting out.

Tradervue Features That Matter

- Public trade sharing with community feedback

- Broker integration with 80+ supported brokers

- Social trading timeline to learn from others

- Advanced analytics including liquidity and exit analysis (Gold tier)

- Mentorship program with experienced traders

- Free tier with 30 trades per month

Tradervue Pricing

| Plan | Monthly | Annual | Free Option |

|---|---|---|---|

| Free | $0 | $0 | 30 trades/month |

| Silver | $29.95 | $323.46 | 7-day trial |

| Gold | $49.95 | $479.52 | 7-day trial |

Who Should Use Tradervue

Tradervue is ideal for traders who want to learn from others and share their journey. The free tier is perfect for low-volume traders, while the community aspect makes it great for those who learn better in a social environment.

The Best Free Trading Journal Options

Let's be real – not everyone wants to pay for a trading journal, especially when starting out. Here are your best free options:

1. TradesViz Basic (Best Overall Free Option)

TradesViz offers the most generous free tier with unlimited trade storage up to 3,000 executions per month. You get basic analytics, performance metrics, and access to some of the platform's powerful features. For most beginner traders, this is more than enough.

2. Tradervue Free (Best for Low-Volume Traders)

With 30 trades per month, Tradervue's free tier is perfect for swing traders or those who don't trade frequently. The social features are also fully available, giving you access to a community of traders.

3. Free Trials

If you want to test premium features before committing, most platforms offer free trials:

- TraderSync: 7-day free trial

- TradesViz Pro/Platinum: 7-day free trial

- TradeZella: No free trial, but consider the Basic plan as a starter option

- Edgewonk: 14-day money-back guarantee

4. DIY Spreadsheet Templates

While not as sophisticated as dedicated software, you can create or download free spreadsheet templates. However, you'll miss out on automatic data import, advanced analytics, and the insights that make modern trading journals so valuable.

What About Trading Journal Apps?

In 2025, mobile trading is more popular than ever, but unfortunately, not all trading journal platforms have caught up. Here's the mobile landscape:

Native Mobile Apps

- TraderSync: Offers fully-featured native apps for both iOS and Android

- Others: Currently, TraderSync is the only platform with true native mobile apps

Web-Based Mobile Solutions

- TradesViz: Excellent progressive web app that works well on mobile browsers

- TradeZella: Responsive web interface that functions well on mobile devices

- Edgewonk: Browser-based with responsive design for tablets and phones

- Tradervue: Web-based interface with mobile optimization

My Personal Take on Mobile Trading Journals

I've been using various trading journal platforms for years, and here's my honest take on the mobile situation: while native apps are nice, most of your serious analysis will happen on a computer anyway. The web-based mobile solutions work surprisingly well for quick trade entries and basic review.

That said, if you're constantly on the go and need to update your journal between meetings or during commutes, TraderSync's native apps are definitely worth the premium.

How to Choose the Right Trading Journal Software

With so many options, how do you choose? Here's my decision framework:

Consider Your Trading Volume

- Low volume (under 50 trades/month): Tradervue Free or TradesViz Free

- Medium volume (50-500 trades/month): TradesViz Pro or TradeZella Basic

- High volume (500+ trades/month): TraderSync or TradesViz Platinum

Factor in Your Budget

- Free: TradesViz Basic or Tradervue Free

- Under $20/month: TradesViz Pro or Edgewonk

- $20-40/month: TradeZella or TraderSync Pro

- $40+/month: TraderSync Premium/Elite for advanced features

Match Your Learning Style

- Visual learner: TradeZella with its clean interface and playbooks

- Data-driven: TradesViz with 600+ statistics and custom dashboards

- Psychology-focused: Edgewonk for behavior analysis and rule tracking

- Community-oriented: Tradervue for social learning and feedback

Consider Your Technical Needs

- Multiple asset classes: TraderSync or TradesViz

- Backtesting and simulation: TradesViz (best-in-class simulators)

- AI-powered insights: TraderSync or TradesViz

- Mobile access: TraderSync (native apps) or any platform (web-based)

Advanced Features to Look For

As you become more serious about trading, certain advanced features become game-changers:

AI and Machine Learning

Both TraderSync and TradesViz offer AI-powered insights, but they work differently:

- TraderSync: Natural language queries and pattern recognition

- TradesViz: AI Q&A for custom analytics and widget creation

Backtesting and Simulation

If you want to test strategies before risking real money:

- TradesViz: Offers the most comprehensive backtesting tools

- TradeZella: Provides trade replay with second-by-second analysis

- TraderSync: Market replay feature (Elite plan only)

Options Trading Features

For options traders, these platforms offer specialized tools:

- TradeZella: Options flow scanner and earnings insights

- TradesViz: Advanced options analytics and 'Greeks' tracking

- TraderSync: Options chain analysis and risk modeling

Common Mistakes to Avoid

After years of using various trading journal platforms, here are the biggest mistakes I see traders make:

1. Choosing Based on Price Alone

The cheapest option isn't always the best value. Consider the time you'll save with better features and the potential improvements to your trading performance.

2. Overcomplicating Your Setup

Don't try to track 50 different metrics if you're not going to use them. Start simple and add complexity as needed.

3. Not Using the Journal Consistently

The best trading journal software is useless if you don't use it. Choose something you'll actually stick with.

4. Ignoring the Data

Don't just collect data – actually review and act on it. Set aside time weekly to analyze your performance.

The Psychology of Trading Journals (And Why They Work)

There's actually fascinating psychology behind why trading journals work so well. When we force ourselves to write down our thoughts and reasoning, we engage different parts of our brain. This process of articulation often reveals flaws in our thinking that we'd otherwise miss.

The act of reviewing past trades also helps build what psychologists call "metacognition" – awareness of our own thinking processes. This is crucial for improving trading performance because it helps us recognize and correct systematic errors.

For more insights into the psychology of traders and decision-making, check out this piece on the psychology of coupons – the same principles of loss aversion and behavioral economics apply to trading.

Frequently Asked Questions

How much should I spend on a trading journal?

Start with free options like TradesViz Basic or Tradervue Free. If you're consistently profitable and trading frequently, investing in paid features makes sense. A good rule of thumb: if your journal helps you avoid just one costly mistake, it's paid for itself.

Can I use multiple trading journals?

Technically yes, but it's not recommended. You'll end up with fragmented data and inconsistent analysis. Pick one platform and stick with it.

How secure is my trading data?

All reputable platforms use encryption and security measures. However, always read the privacy policy and understand how your data is stored and used.

What if I change brokers?

Most platforms support multiple brokers, so you can usually continue using the same journal. Check the broker compatibility list before switching.

Should I track every single trade?

Yes, especially when starting out. Even small trades can reveal patterns, and the habit of consistent tracking is more important than the individual trade size.

The Future of Trading Journals

The trading journal space is evolving rapidly, with some exciting trends on the horizon:

AI-Powered Coaching

We're seeing more platforms integrate AI coaches that can provide personalized feedback and strategy suggestions based on your trading patterns.

Real-Time Analysis

Future platforms will likely offer real-time analysis and alerts, helping you make better decisions while you're actively trading.

Integration with Trading Platforms

Expect deeper integration between journals and trading platforms, making data entry even more seamless.

Social Trading Features

More platforms will likely adopt social features, allowing traders to learn from each other in structured ways.

Making Your Decision

Choosing the right trading journal software is a personal decision that depends on your trading style, budget, and learning preferences. Here's my final recommendation based on different trader profiles:

For Beginners: Start with TradesViz Basic (free) or Tradervue Free to get into the habit of journaling without financial commitment.

For Serious Traders: TraderSync offers the most comprehensive features, while TradesViz provides excellent value for money.

For Psychology-Focused Traders: Edgewonk's unique approach to behavioral analysis is worth the investment.

For Educators and Mentors: TradeZella's mentor mode and educational features make it perfect for those who teach or learn from others.

Remember, the best trading journal software is the one you'll actually use consistently. Don't get caught up in having every possible feature – focus on what will help you improve your trading performance.

Final Thoughts

After testing all these platforms extensively, I'm impressed by how sophisticated trading journal software has become. We've moved far beyond simple spreadsheets to platforms that offer AI insights, comprehensive analytics, and educational tools.

The key is to start somewhere – even if it's just with a free account – and begin building the habit of consistent journaling. As you become more serious about trading, you can always upgrade to more advanced features.

Most importantly, remember that a trading journal is only as good as the effort you put into it. The software can provide insights and make the process easier, but it's up to you to act on the information and improve your trading performance.

Ready to get started? Check out the latest deals and discounts for TradeZella and TraderSync to save on your subscription.

Happy trading, and may your journal be filled with profitable insights!