TraderSync vs TradeZella: Which Trading Journal Is Right For You? (2025 Comparison)

Disclaimer: This post is not sponsored by TradeZella, TraderSync or any related company. However, it may contain affiliate links, which help support our site at no extra cost to you. All opinions expressed are independent and based on real user reviews and data gathered from trusted sources.

What Makes a Good Trading Journal? (And Why You Absolutely Need One)

Let me start with something I've learned the hard way: consistent trading success is nearly impossible without proper tracking and analysis.

In my early trading days, I'd make the same mistakes repeatedly without realizing it. Sound familiar? I'd forget which strategies worked, which failed, and—most importantly—why they succeeded or bombed. My trading was essentially a game of emotional roulette.

That's why trading journals have become non-negotiable tools for serious traders. They transform vague impressions ("I think that strategy works well") into concrete data ("This strategy has a 67% win rate with a 2.3:1 reward-to-risk ratio when used during market open").

But not all trading journals are created equal. Today, we're comparing two heavyweights in the journal space: TraderSync and TradeZella. Both have passionate user bases, but they serve different needs and trading styles.

Let's figure out which one deserves your subscription dollars.

Quick Verdict: TraderSync vs TradeZella

Short on time? Here's the condensed comparison:

Choose TraderSync if:

- You're all about the data and metrics

- You want powerful AI-driven insights

- You need integration with obscure brokers (900+)

- You prefer a cleaner, more intuitive interface

- You value detailed performance reports

Choose TradeZella if:

- Tracking trading psychology is important to you

- You want community features and educational resources

- You need advanced playbook documentation

- You're looking for psychology-linked performance metrics

- You manage multiple portfolios and need consolidated views

Both platforms are excellent, but they emphasize different aspects of trading improvement. Now let's dive deeper to help you make the right choice.

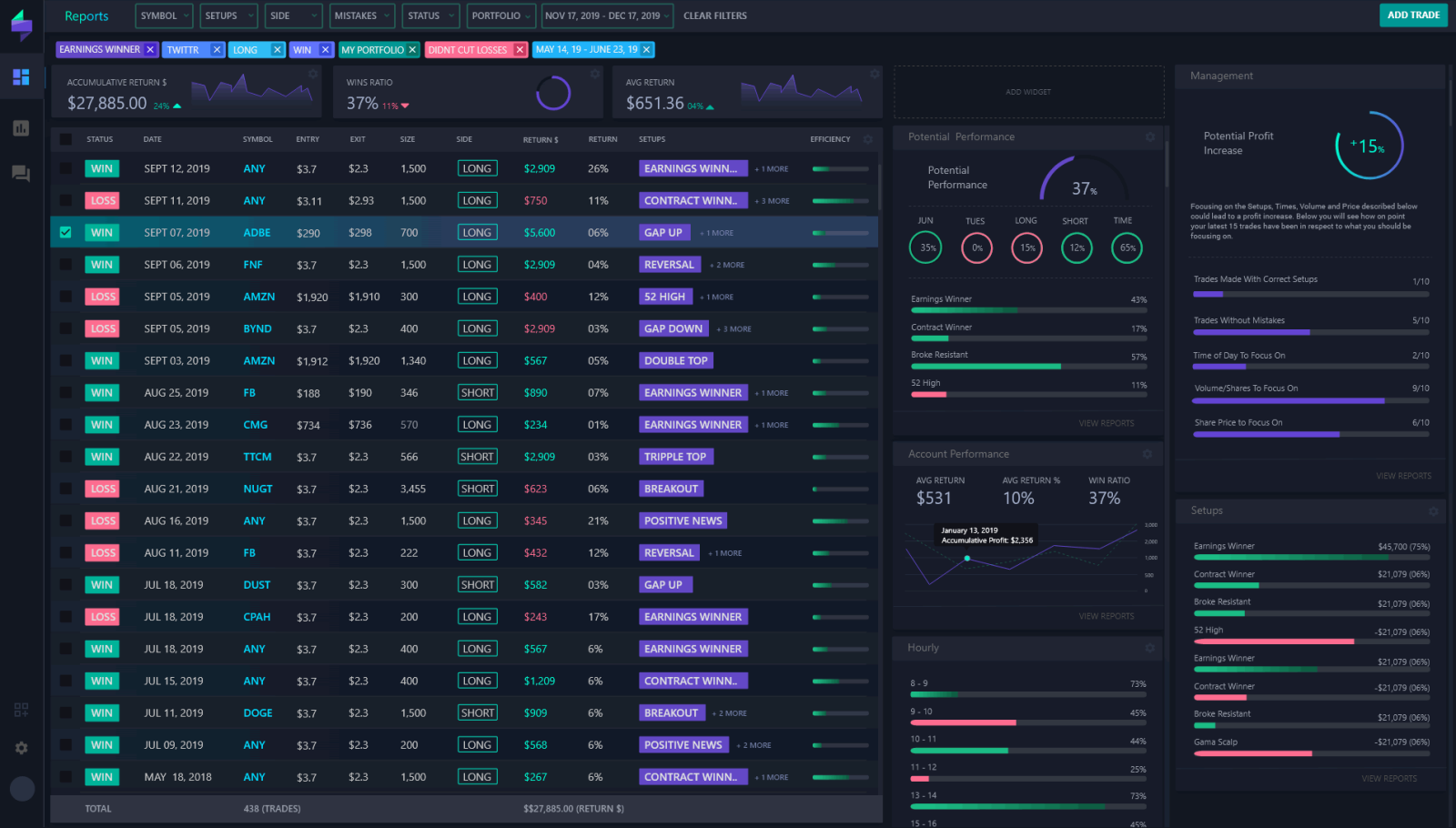

TraderSync: The Data-Driven Trader's Dream Tool

TraderSync's intuitive dashboard makes spotting winning and losing patterns immediately obvious.

TraderSync has built a reputation as the analytics powerhouse of trading journals. With its clean interface and powerful reporting capabilities, it focuses on turning your trading history into actionable insights.

Key Strengths of TraderSync

1. Exceptional Analytics Capabilities

The platform shines brightest in its ability to slice and dice your trading data. Want to know your performance by:

- Time of day

- Market sector

- Entry price

- Position size

- Day of week

- Market conditions

TraderSync can show you all of this with a few clicks. The color-coded performance calendar alone is worth the subscription price—immediately identifying your profitable days and problematic periods.

2. Impressive Broker Integration

With connections to over 900 brokers worldwide, TraderSync likely supports whatever platform you're using. This means no more manual data entry (unless you want to add specific notes).

I remember spending hours each weekend entering trade data before discovering automated journals. Trust me, those hours are better spent analyzing patterns or, you know, actually living your life.

3. AI Assistant That Actually Helps

TraderSync's Premium tier includes an AI assistant that can analyze your trading patterns and suggest improvements. Unlike generic AI tools, this one is specifically trained on trading data.

You can ask questions like:

- "Which setup generated my best returns this month?"

- "What time of day am I most profitable?"

- "Am I overtrading during market open?"

And receive data-backed answers specific to your trading history. It's like having a trading coach who knows your every move.

4. Clean, Intuitive Interface

Something that doesn't get enough attention is just how well-designed TraderSync's interface is. When you're reviewing hundreds of trades, having clear visualizations and logical organization makes all the difference.

The dashboard immediately shows you what's working and what isn't—no digging required.

Potential Drawbacks of TraderSync

1. Premium Price Point

TraderSync is positioned as a premium product with pricing to match. While they offer tiered subscriptions (Pro, Premium, and Elite), many of the most valuable features are locked behind higher tiers.

Is it worth it? If you're trading regularly and seriously, absolutely. However, casual traders might find the cost hard to justify.

2. Limited Community Features

If you're looking for community engagement, TraderSync isn't focused there. While the platform excels at personal analytics, it lacks the social and educational components some traders value.

3. Learning Curve for Advanced Features

While the basic interface is intuitive, getting the most from TraderSync's advanced reporting requires some time investment. The learning curve isn't steep, but it exists.

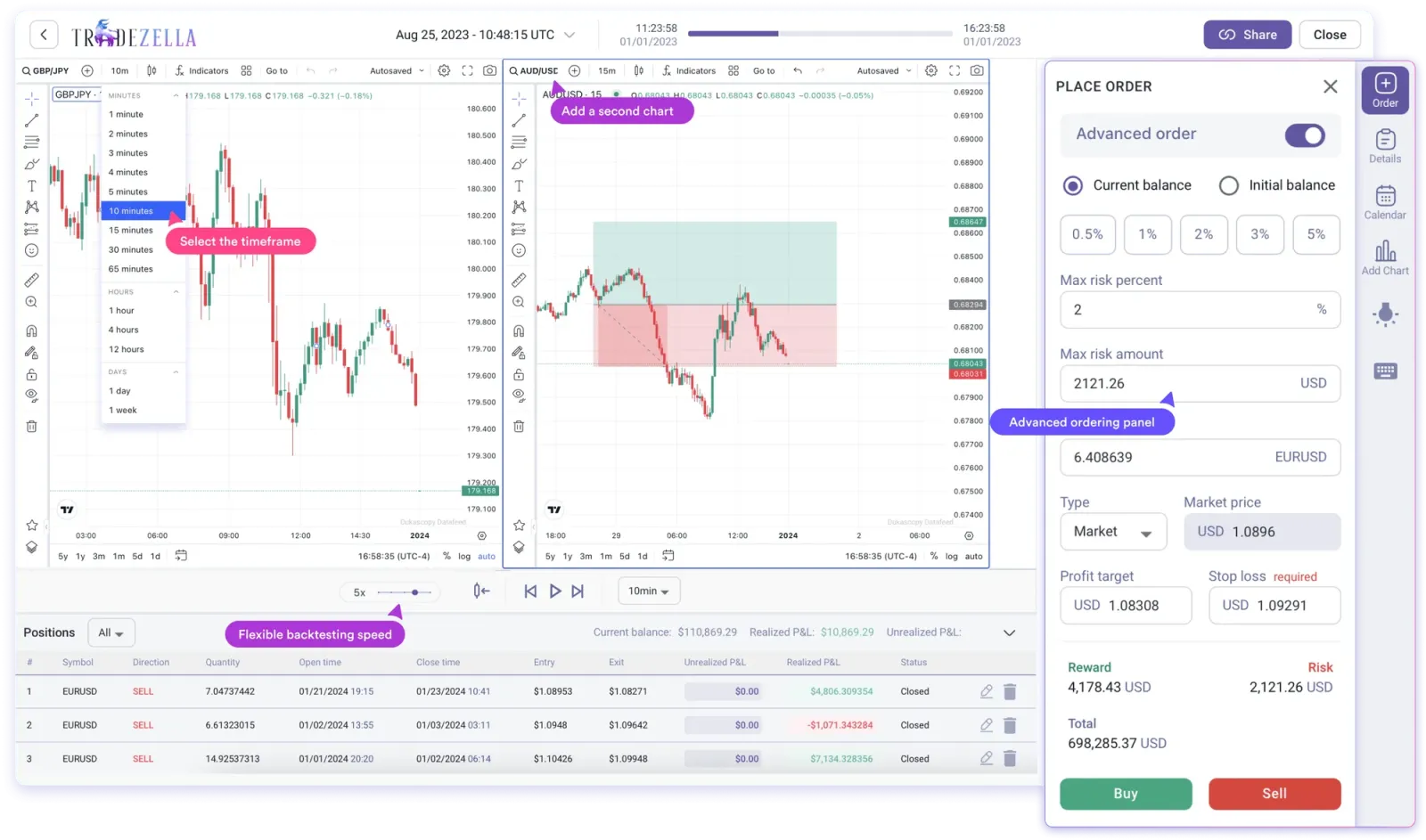

TradeZella: Where Psychology Meets Performance

TradeZella uniquely links emotional states to trading outcomes, helping you identify psychological patterns.

TradeZella takes a different approach, emphasizing the psychological aspects of trading alongside traditional metrics. It positions itself as a holistic platform for understanding not just what you traded, but why and how.

Key Strengths of TradeZella

1. Psychological Insights

TradeZella's standout feature is its psychology journaling capability. The platform allows you to document:

- Your emotional state before, during, and after trades

- Stress levels and their impact on decision-making

- External factors affecting your trading mindset

These psychological data points are then correlated with your performance metrics, revealing patterns you might otherwise miss.

I've personally discovered that my worst trades often follow periods of overconfidence—something I wouldn't have identified without specifically tracking my psychological state alongside performance.

2. Trading Playbook Documentation

TradeZella excels at helping you formalize your trading strategies into documented playbooks. The platform then tracks how consistently you follow these playbooks and measures their effectiveness.

This feature is particularly valuable for traders working to improve discipline and consistency. When you can see that "Strategy A" works 75% of the time when followed correctly, it becomes easier to trust your system rather than your emotions.

3. Community and Educational Resources

Unlike TraderSync, TradeZella places significant emphasis on community engagement. The platform offers:

- Integration with trader communities

- Educational webinars

- Trading bootcamps

- The ability to share trades with mentors or friends

For many traders, especially those early in their journey, this community aspect provides tremendous value.

4. Multi-Portfolio Management

If you trade across multiple accounts or strategies, TradeZella makes it easy to track performance across all of them while still maintaining separate analytics.

Potential Drawbacks of TradeZella

1. Interface Complexity

With its wealth of features, TradeZella's interface can sometimes feel overwhelming, especially for new users. The learning curve is steeper than with TraderSync.

2. Subscription Cost

Like TraderSync, TradeZella isn't the budget option in the trading journal space. Its comprehensive feature set comes with premium pricing.

3. Feature Overwhelm

Not everyone needs or wants to track psychological factors. Some traders might find TradeZella offers features they'll never use, making its complexity unnecessary for their needs.

Feature-by-Feature Comparison

Now let's dive deeper into specific feature comparisons to help you decide which platform better suits your trading style.

Trade Import and Documentation

TraderSync:

- Automated import from 900+ brokers

- Manual entry option (though somewhat time-consuming)

- Basic note-taking capabilities

- Trade tagging system

TradeZella:

- Multiple import methods (broker sync, file upload, manual)

- Psychology-focused documentation

- Detailed notes linking emotions to outcomes

- Playbook documentation and tagging

My Take: TraderSync wins for pure automation and breadth of broker connections, but TradeZella offers more comprehensive documentation options, especially if psychological factors matter to you.

Analytics and Reporting

TraderSync:

- Detailed performance reports by multiple variables

- Calendar view with color-coded performance

- Win/loss analysis by setup type

- Advanced filtering capabilities

- AI-powered insights (Premium tier)

TradeZella:

- Visual P&L tracking throughout trades

- Strategy-type performance measurement

- Embedded TradingView charts showing entry/exit points

- Psychology-correlated performance metrics

- Multiple portfolio consolidated views

My Take: Both platforms excel here, but with different emphasis. TraderSync focuses on pure performance metrics while TradeZella connects performance to psychology and strategy adherence.

User Experience and Interface

TraderSync:

- Clean, intuitive dashboard

- Color-coded performance indicators

- Logical information hierarchy

- Mobile-responsive design

- Faster learning curve

TradeZella:

- Feature-rich interface

- Cloud-based accessibility from any device

- Integrated TradingView charts

- More complex navigation

- Steeper learning curve

My Take: TraderSync offers a cleaner, more intuitive experience that gets you to insights faster. TradeZella sacrifices some simplicity for additional functionality.

Community and Education

TraderSync:

- Limited community features

- Focus on personal analytics

- Some educational webinars and blog content

- Live chat support during business hours

TradeZella:

- Strong community integration

- Webinars and bootcamps

- Ability to share trades with mentors

- Educational content library

My Take: TradeZella clearly emphasizes the community aspect more than TraderSync. If learning from others is important to you, TradeZella has the advantage here.

Trade Replay and Review

TraderSync:

- Stock market replay (higher-tier subscriptions)

- Historical market condition review

- Basic chart markup tools

TradeZella:

- Integrated TradingView charts

- Entry/exit visualization

- Advanced chart markup

- Replay functionality

My Take: TradeZella's TradingView integration gives it an edge for visual traders who want to see their entries and exits directly on charts.

Pricing Breakdown

While exact pricing fluctuates with promotions and plan changes, here's a general overview of the pricing structures:

TraderSync Pricing Tiers

- Pro Plan:

- Basic journaling capabilities

- Limited reporting functions

- No AI features

- Best for: Beginning traders or those on a budget

- Premium Plan:

- Advanced reporting

- Some AI capabilities

- Additional performance metrics

- Best for: Intermediate traders seeking deeper insights

- Elite Plan:

- Full AI assistant access

- Complete reporting suite

- Stock market replay

- Best for: Professional traders or those managing significant capital

TradeZella Pricing Tiers

TradeZella also operates on a tiered model, though specific details weren't fully covered in the reference materials. However, users note it as "relatively high subscription pricing" with various access levels to features.

Budget Tip: Both platforms occasionally offer promotional discounts, especially around major trading holidays or events. Check TradeZella Deals for updated promotional codes that might reduce your subscription costs.

User Trust and Reviews

TraderSync Trustpilot Rating: 4.7/5

- Ease of use and intuitive interface

- Effectiveness in identifying trading patterns

- Ability to improve strategies based on insights

- Customer support responsiveness

TradeZella Trustpilot Rating: 4.4/5

- Psychological tracking capabilities

- Community features

- Analytical depth

- Playbook functionality

Personality Match: Finding Your Trading Journal Fit

Choosing between these platforms often comes down to your trading personality and goals. Let's explore which type of trader typically gravitates toward each platform.

You Might Prefer TraderSync If You Are:

- Data-driven and love metrics above all else

- Process-oriented with well-established trading systems

- Visually motivated by clean, intuitive interfaces

- Time-conscious and want insights quickly

- Independent and prefer to analyze on your own

- Technically focused on chart patterns and setups

I find TraderSync appeals particularly to traders with a mathematical or engineering mindset—those who want the numbers to tell the story without much emphasis on the psychological components.

You Might Prefer TradeZella If You Are:

- Psychology-aware and recognize emotions impact your trading

- Community-oriented and value learning from others

- Strategy-developing and still refining your approach

- Multi-dimensional in how you evaluate performance

- Detail-oriented and want to document everything

- Growth-focused and learning-oriented

TradeZella tends to attract traders who recognize trading success involves both technical proficiency and psychological mastery. If you've ever said, "I know what to do, I just struggle to do it consistently," TradeZella's psychology tracking might be your missing link.

Making Your Decision: A Framework

Still struggling to choose? Consider these questions:

- What's your primary goal?

- Pure performance improvement → TraderSync

- Psychological mastery and performance → TradeZella

- How important is community?

- Very important → TradeZella

- Not essential → TraderSync

- What's your learning style?

- Visual and data-driven → TraderSync

- Introspective and analytical → TradeZella

- What's your trading frequency?

- High-volume trader → TraderSync's efficiency shines

- Lower volume with focus on quality → Either works well

- What's your budget comfort level?

- Looking for value in essential features → Compare base tiers

- Willing to pay for comprehensive tools → Compare premium tiers

Beyond the Platforms: Best Practices for Trading Journals

Whichever platform you choose, here are some best practices I've learned for getting the most from your trading journal:

1. Be Religiously Consistent

A trading journal only works if you use it consistently. Make journaling part of your daily routine—ideally immediately after your trading session while everything is fresh.

2. Focus on Process Over Results

Document your adherence to your trading rules, not just profits and losses. Many successful traders find their results improve when they focus more on following their system than on the outcome of any single trade.

3. Review Weekly and Monthly

Daily updates are essential, but the real insights come from weekly and monthly reviews where you can spot patterns that aren't obvious in day-to-day trading.

4. Be Brutally Honest

A journal that sugarcoats your mistakes is worthless. Document your errors, emotional reactions, and rule violations with complete honesty.

5. Track External Factors

Sleep quality, stress levels, significant news events—all these can impact your trading. Note them alongside your trades to identify correlations.

My Personal Experience: Why I Journal Every Trade

I started seriously journaling my trades three years ago, and the difference has been night and day. Before journaling, my trading was inconsistent at best—occasional big wins followed by frustrating streaks of losses.

Once I began documenting every trade with a professional platform, patterns emerged that I'd been completely blind to:

- I discovered I was significantly more profitable in the first two hours of market opening

- My win rate on breakout trades was nearly double that of reversal setups

- I had a tendency to exit winning trades too early, but let losing trades run too long

- My performance suffered significantly on days when I slept less than 7 hours

These insights helped me refine my trading plan to focus on setups with proven success and avoid trading during my statistically weaker periods. The result? A much more consistent equity curve and dramatically reduced stress.

Whether you choose TraderSync, TradeZella, or another platform, the simple act of systematic documentation and review will transform your trading.

Conclusion: The Right Tool for Your Trading Journey

Both TraderSync and TradeZella offer powerful capabilities that can help elevate your trading to the next level. Rather than declaring an overall winner, I encourage you to consider which platform better aligns with your specific needs and trading style.

TraderSync excels in data-driven analytics, clean interface design, and intuitive performance tracking. It's ideal for traders focused primarily on the numbers and technical aspects of their trading.

TradeZella offers a more holistic approach that incorporates psychological factors, community engagement, and detailed playbook documentation. It's perfect for traders who recognize the mental game is just as important as technical analysis.

Whichever platform you choose, remember that the most powerful journal is the one you'll actually use consistently. Both offer free trials, so I recommend testing each to see which feels more intuitive for your specific needs.

And don't forget to check TradeZella Coupon Codes for potential discounts before subscribing—saving on your journal subscription means more capital for your actual trading!

Have you used either platform? I'd love to hear about your experience in the comments below!

Disclaimer: This article contains general information only and is not intended as financial advice. Always conduct your own research before making investment decisions or choosing trading tools.